- Cyber risks have evolved significantly over the last couple of years across industry sectors. Cybersecurity is a matter of growing concern as cyber-attacks cause loss of income, sensitive information leaks, and even vital infrastructures to fail.

- The BFSI industry, in particular, has become the target of choice with malicious actors exploring every avenue they can in order to identify areas of vulnerability. Though the financial sector has invested hugely in security – and, logically, it is among the most advanced when it comes to IT security. But clearly, there is more to be done.

Security Breaches in BFSI industry of India

- Union Bank: Hackers managed to steal Union Bank’s Access Codes for the Society for worldwide Interbank Financial Telecommunication (SWIFT)

- Axis Bank: Unauthorized login by an unnamed, offshore hijacker

- Hitachi Payment Systems: Malware Caused breach of Bank data

- Yes Bank: Malware attacked some ATMs and POS machines

- Bank of Maharashtra: Central Server Hacked

Source : The Economic Times

READ MORE >> Analysing/Dissecting Uber Subdomain Takeover Attack

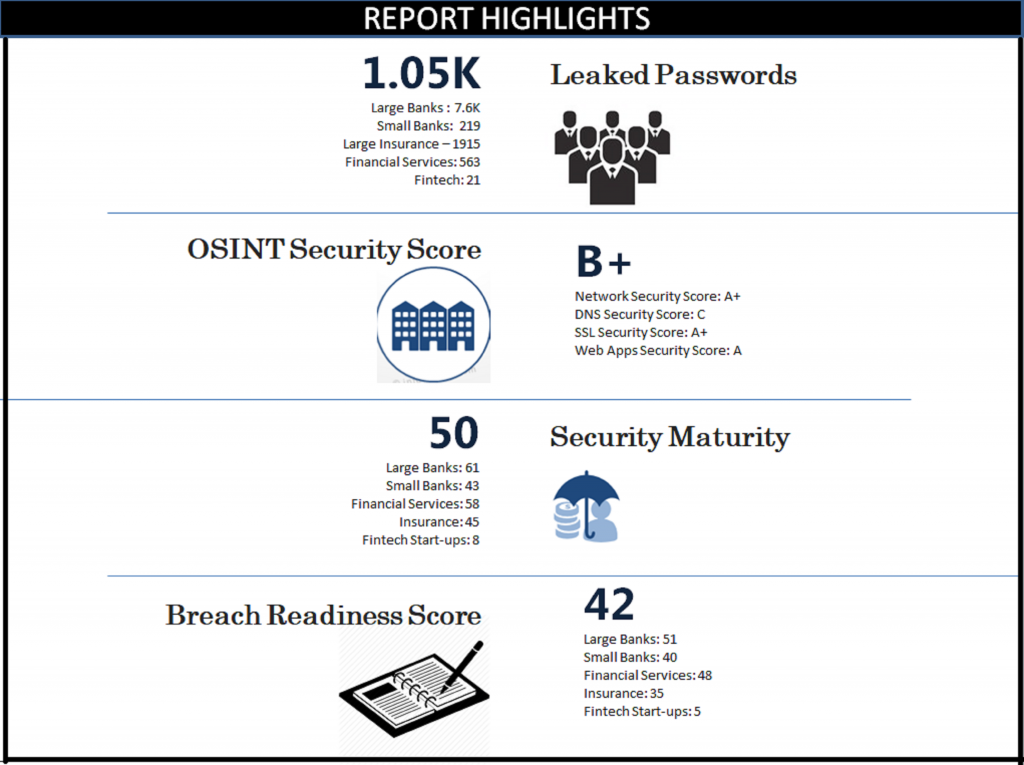

Security Score Snapshot for Indian BFSI Industry

Key Findings

- An average OSINT Score of B+ doesn’t justify the cyber security system in place for BFSI Sector

- Banking sector in India is found to have an established, strong encrypted links between their server and client browser, with most of the banking organisation having an A+ average rating in terms of their SSL score

- Large Indian Banks and Telcos are the most mature with average score of ~60% with Small Banks still lagging far behind at ~45%

- Insurance sector in India is found to have an established, strong encrypted links between their server and client browser, with each of the sector having an A+ rating in terms of their SSL score

- Client- Server Computer programs for Financial services are found to be poorly performingagainst potential cyber attacks with an average web-app security score rating of below B+

Comments